By Steve Fahy

.jpg)

The role of bonds in the typical portfolio allocation are changing from this point forward. Refer to the interest rate chart below. It shows the 10-year US Treasury rate for the past twenty-five years. During that period of time, interest rates were falling and bond prices were rising. Having bonds in a portfolio allocation were an alternative to equities and during this long period of time, provided an asset that was gaining value and producing interest.

Source: Bloomberg

Having bonds in a portfolio allocation now, based on today’s interest rate environment, will likely generate very little income and be an asset that will continually lose value over time, until maturity of the asset, if individual bonds are held. Bonds are still an alternative to equities and provide a balance to a portfolio, but in our opinion, the old traditional 60-40 split has become outdated. That 40% of bond holdings need to be reduced and a replacement needs to be found.

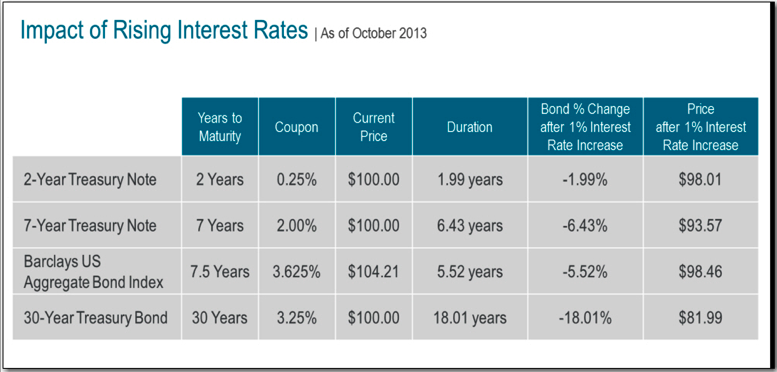

In a rising interest rate environment, intermediate-term and long-term bond maturities are at the highest risk. A bond that matures in seven years, with a duration of 6.43 years, will lose 6.43% of its value when interest rates rise by 1%. A 30-year maturity, with 18.01 years of duration, records an 18.01% drop in value with a 1% interest rate rise. More so now than ever before, “past performance is not indicative of future results!”

Bonds will always have a role in portfolio allocation and as interest rates plateau, as they always do, then longer term bonds will be more attractive for a period of time. But for the next several years, some part of the old bond allocation percentage needs to find a new home. As rates are in a rising period, we feel that 40% of the bond allocation should be moved to non-traditional fixed income investments. Again, as rates plateau, we believe then that percentage should range between 20% and 40%.

Source: Bloomberg

What are “non-traditional fixed income” investments and what are their advantages? “Non-traditional fixed income” investments have the ability to go long and short across a range of fixed income investments. They have the ability to invest across various credit qualities and maturities. Most importantly, they have the potential to reduce a bond portfolio’s sensitivity to interest rate movements.

We anticipate seeing some interest rate movements by the Fed in the latter part of 2015. The markets will more likely be impacted by rising interest rates in 2016. As we move into this new environment, we will see our bond allocations take on a new look to protect our portfolios.